Tailored M&A Deal Sourcing Solutions

Exclusive Opportunities, Exceptional Deal Flow

Rollups, Acquisition Strategy and Opening Doors for our Clients

Looking to increase your deal pipeline? Trying to get access to a specific target that won’t answer your calls? Need help developing or refining your acquisition strategy?

Our team has sourced deals for some of the largest private equity groups, payments companies, and software companies in the business, for over 20 years. Deal sourcing is as much a science as it is an art. We open doors that others can’t, because after years of outreach, there’s a careful and thought-out approach to every call and email that gets us in the door.

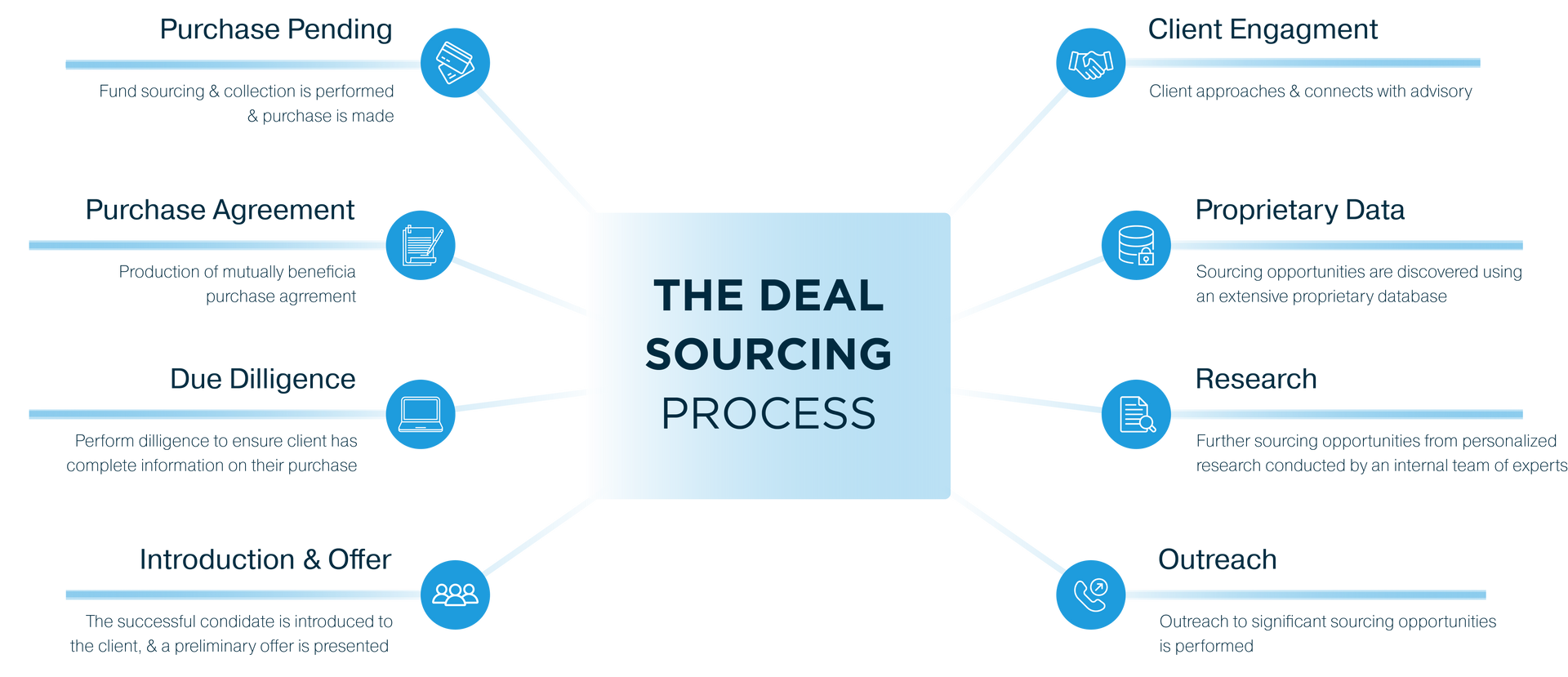

Deal Sourcing Process

Buying or Executing on an Acquisition Campaign

We’ve made a successful career executing on buy-side deal sourcing initiatives for clients with deal sizes ranging from $2M to $400M. From rollups, to building an acquisition strategy and opening doors for clients, 733Park will get you there.

Click the image to View and Download Our Deal Sourcing Process Infographic

Strategic Advantages of Expert M&A Deal Sourcing

Our History is Rich in Deal Sourcing

733Park’s managing director, Lane Gordon, has successfully performed deal origination for hundreds of strategics, PE firms and public companies including roll-ups for public and privately held entities. 733Park has assisted a wide range of companies with different strategies, targets, and experience in deal sourcing.

Previous Clients

Our experience in the industry has exposed us to a wide variety of different companies with different buy-side goals, and we were able to give them all great results.

GreenBox POS, a fintech company using blockchain technology for payments, needed to acquire a credit card processing company for a new BIN sponsorship agreement. They engaged our deal sourcing team, and gave us their specifications. 733Park compiled a list of targets, narrowed down the search, reached out to them, and ultimately brought them Northeast Merchant Systems. From the time of the engagement to the acquisition, was less than 90 days.

Fullsteam, a holding company that invests in ISV and SaaS businesses, reached out to Lane for deal sourcing. They needed to find potential software and SaaS acquisitions that had monetizable merchant services. Lane and team identified a wide range of targets and verticals for Fullsteam, ultimately identifying and deal sourcing Xudle, a management and payment firm in the wine industry, Event Rental Systems (ERS), the leading software for party rental companies, and Agile Software and Marketing, the creator of Party Center Software.

Lane Gordon also deal sourced the majority of acquisitions for Heartland Payment Systems (NYSE: HPY), one of the nation’s largest payment processors, prior to their acquisition by Global Payment Systems (NYSE: GPN). Heartland Payment Systems needed help finding targets in the education sector with an eye towards building their market share in education tech/government payments. Lane Gordon was able to find, reach, and ultimately persuade multiple acquisition targets, who weren’t even on the market, to speak with his client and come on board. TouchNet Information Systems and MCS Software, ECSI, Lunchbyte, SL Tech, and LunchBox were all acquisitions where Lane performed deal origination and deal sourcing for Heartland. Lane ended up assisting them with the majority of their deal origination and acquisitions. He helped Heartland go from a zero percent share in ed tech to a 50% share in 3 years.

Pivotal Payments, now known as Nuvei (Toronto Stock Exchange: NUVCF), is another publicly traded client who Lane had deal sourced acquisitions. They are a leading provider of merchant services and global payment processing solutions. Lane Gordon did deal origination with a number of their merchant portfolio and ISO acquisitions in the credit card processing industry. Nuvei also acquired Capital Processing Network (CPN), a company that expanded their merchant services and credit card processing to point of sale businesses into the U.S. American National Payments (ANP) was yet another one that was sourced for Pivotal. The deal gave Nuvei an established ISO sales partner in ANP, and enhanced their sales channels.

Paysafe (fka Optimal Payments, NYSE: PSFE), is a publicly traded company who reached out to our team. They are a global leader in simple and secure payment solutions for businesses of all sizes. Lane Gordon deal originated acquisitions for Paysafe’s merchant portfolio in the payments and credit card processing field. Paysafe also acquired MeritCard Solutions, which helped improve their underwriting, operations, risk management, and merchant retention. MeritCard Solutions brought hard work and reputation to Paysafe, and was named a top 100 Merchant Acquirer over the last 4 years by Nilson.

733PARK at a Glance

$10.

Billions in Transactions

25+

Years of Business Growth

187

Transactions to Date

140%

Average Creation Worth

Past Deal Sourcing Success

successful highlights

Alipse Systems

I told 733Park what I wanted—and they delivered. Not just my list, but off-market gems I didn’t even know existed. We closed multiple deals that never saw a teaser. Total edge.

— Alipse Systems

Fullsteam

Lane cracked open doors that weren’t opening for anyone. He brought us high-quality SaaS targets and got us into conversations that led to real deals. Multiple closes, zero noise.

— Fullsteam

Nuvei

Lane brought us a dozen+ real opportunities—and we ran with them. His access and instincts in payments and ISVs are next level. We’re still benefiting from those plays today.

— Nuvei

FAQs

How does 733Park assist buyers in the M&A process?

For buyers, 733Park offers unique industry access, facilitates discussions with key stakeholders, and structures deals leveraging years of experience and industry connections.

What support does 733Park provide to sellers?

733Park educates sellers on finding the right buyer, emphasizes deal structure to reflect appropriate pricing, and ensures effective negotiations to bring the right parties together

How does 733Park ensure successful exit strategies for clients?

By leveraging its industry knowledge and experience, 733Park develops tailored exit strategies that align with clients' goals, maximizing value and ensuring smooth transitions.

Testimonials

CLIENT 1

CLIENT 2

CLIENT 3

733Park guided us seamlessly through our transaction with clarity and unmatched expertise. They understood exactly what our fintech company needed, negotiated strategically, and delivered results beyond our expectations.

— R.L., Founder

From the outset, Lane Gordon and the 733Park team were proactive, strategic, and fiercely dedicated. They brought us qualified buyers quickly and secured an outstanding outcome for our payments company. Highly recommended.

— S.M., CEO

When selling our SaaS business, we wanted advisors who truly understood our industry and knew the right buyers. 733Park exceeded every expectation—securing a deal at a valuation we didn't think possible. Exceptional from start to finish.

— J.H., Owner

Insights

on the market

Strategic M&A Starts Here

contact us

We have led both public and private entities through successful transactions in FinTech, SaaS, and payments. Using the relationships we’ve built in the industry, we can open doors that others can’t and help you maneuver a field that is constantly changing. We can get you the highest price possible and best terms for your ISO or merchant portfolio -- when you’re contemplating a transaction, experience matters.

Contact us to discuss your Deal Sourcing project. Fill out the invitation form or call us for a FREE Consultation at (617) 564-0404.