Post-Settlement Funding for Attorneys

Post-Settlement Funding for Attorneys

Accelerate Your Fees with Post-Settlement Funding

The Post-Settlement Waiting Game

Even after a case settles, attorneys may still find themselves waiting for their hard earned fees. Settlements of larger cases might take years of review before final fee distribution, and cases involving minors, Medicare and Medicaid liens, governments, international entities, or other groups often require months or years of extra work before payout. That means that attorneys who litigate long, complex cases may not get paid for months or even years after finally reaching a successful outcome.

This huge gap between payments can cause major cash flow problems. Attorneys need money to pursue new clients, build successful cases, and continually improve their skills. Without access to their fees, attorneys struggle to run an effective practice.

Post-Settlement Attorney Fee Advances: A Solution For Lawyers Waiting On Delayed Legal Fees

Balanced Bridge Funding offers post-settlement attorney funding, more commonly referred to as attorney fee acceleration, to lawyers working on a contingency fee basis so that they can have expedited access to their hard earned settlement fees. Although this specialized form of legal financing is less common than an attorney line of credit or pre-settlement funding, post-settlement funding can be a lifesaver for attorneys waiting on a slow-paying settled fee.

Here’s How a Post-Settlement Fee Advance Works:

- You, the attorney, are awaiting payment after reaching a favorable outcome for your client.

- Balanced Bridge Funding purchases a portion of your fee.

- Balanced Bridge Funding then provides you with a post-settlement fee advance based on this portion of your fee we purchased.

- After the settlement pays out, Balanced Bridge Funding is directly repaid from the case administrator, lead counsel, or from your escrow account.

- Because we only purchased a portion of your fee, you are still paid the remainder owed to you.

Post-settlement funding can reduce your financial stress and help you and your business stay afloat while you are waiting for a settlement to pay out.

Post-Settlement Funding is NOT a Lawsuit Loan

Unlike a loan, post-settlement funding allows you to access your own money before you normally would, so you will not have to worry about making monthly payments to a lender. When your case does finally pay out, your obligor pays Balanced Bridge Funding directly.

We Fund Any Type of Settlement with a Delay in Payout

We fund all types of settlements where there is a delay between time of settlement and disbursement of your fee, including, but not limited to:

- Class Actions

- Infant Injuries

- Product Liability

- Personal Injury

- Truck Accidents

- Mass Torts

- Multi-District Litigation

- Employment Discrimination

- Wrongful Death

- Slip & Fall

- Medical Malpractice

Relax, We Accept All the Risk

Balanced Bridge Funding accepts all risk of non-payment. If for some reason the defendant/obligor is unable to pay the settlement, you will still keep the money from your advance.

Quick, Hassle Free Application Process

If you think that post-settlement attorney fee funding might be the right fit for you, call 267-457-4540

to speak to one of our legal funding experts. Or to apply online, simply

CLICK HERE and fill out our quick form application.

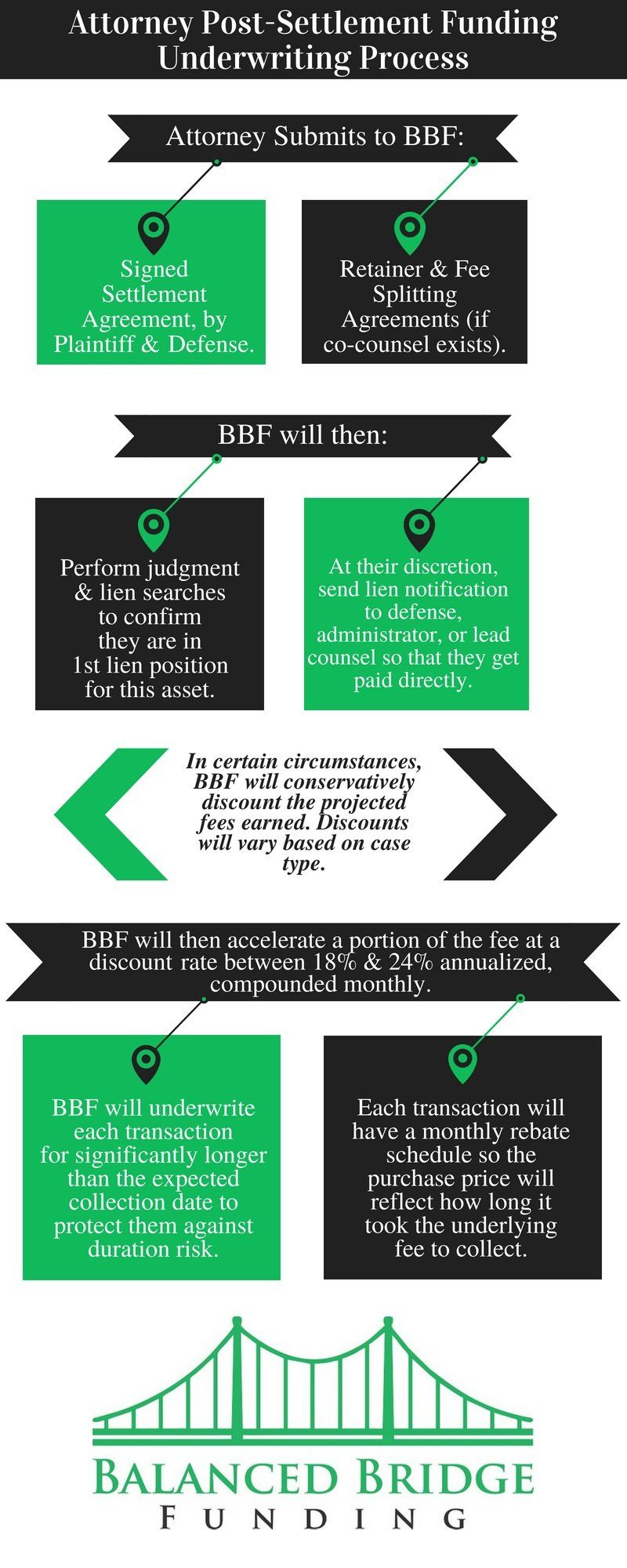

Infographic Explaining the Underwriting Process for Attorney Post-Settlement Advances:

Check out our 3 in-depth Legal Funding Resource Guides:

This is an all inclusive guide on consumer legal funding as it pertains to both the attorney and plaintiff. After reading this guide, you'll have the knowledge to answer the following questions about consumer legal finance:

- What is legal funding?

- How is legal funding different than a bank loan?

- What other types of financial options exist?

- When should I use legal funding?

- How does legal funding work?

- What does a legal funding application look like?

- What are the different types of legal funding?

- What are some real-world examples of legal funding?

2.

Attorney Funding: The Essential Guide

Click Here to Learn More About Attorney Funding

This resource guide was written specifically for the plaintiffs' attorney. This guide contains:

- A step-by-step review of the application and funding process.

- Comparisons between legal funding and other potential financial options.

- Full explanations of the benefits legal funding can provide both attorneys and plaintiffs.

- Detailed overviews of five different kinds of legal funding.

This detailed resource goes into detail about everything you've ever wanted or needed to know about the consumer plaintiff lawsuit funding space.

Balanced Bridge Has Been Seen On:

Contact Info

40 E. Montgomery Avenue

40 E. Montgomery Avenue

Suite 416

Ardmore, PA 19003

Phone:

267-457-4540

Email:

info@balancedbridge.com